##MP##

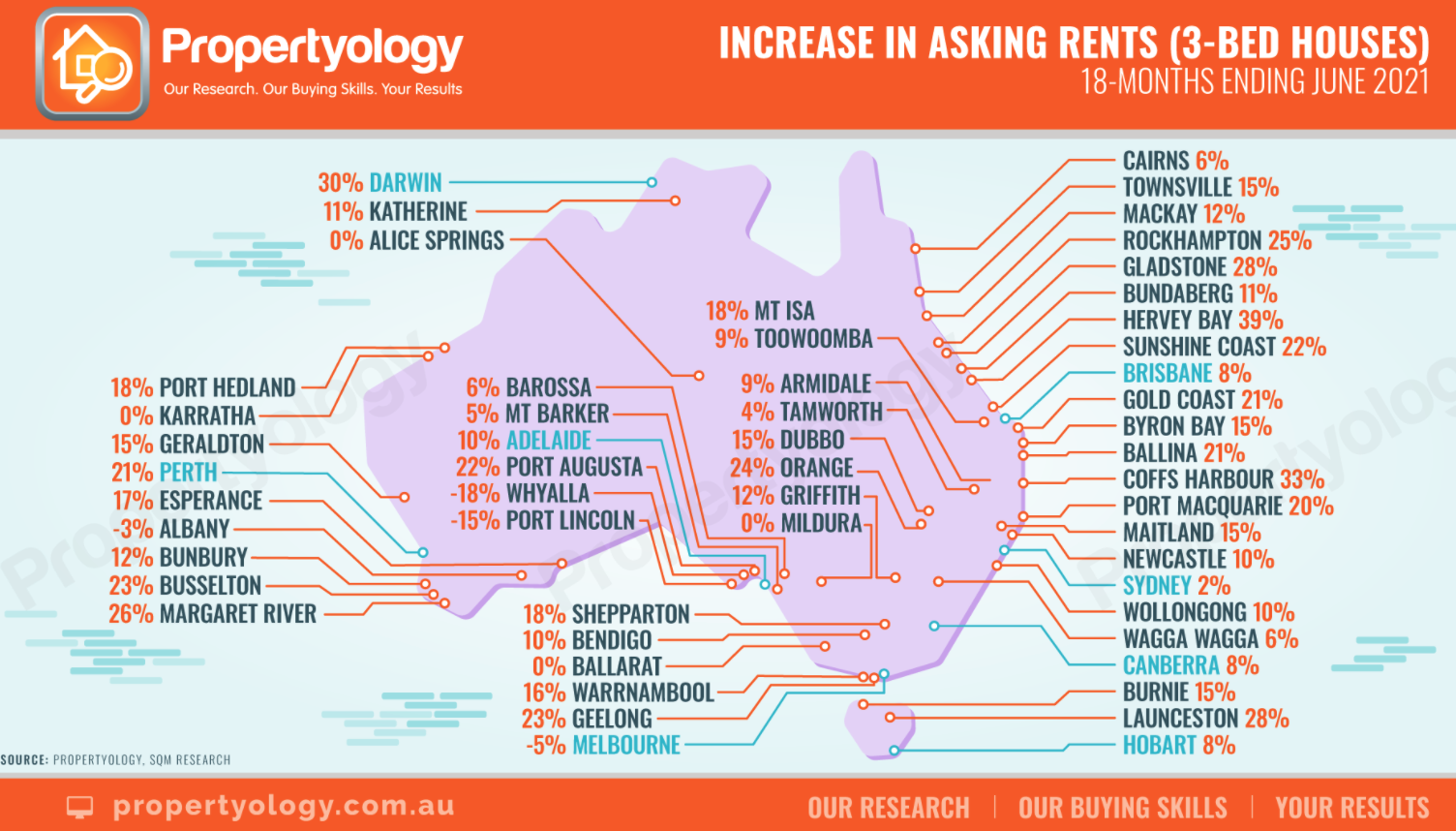

New research shows the cost of renting in Cairns has climbed six-per-cent in the past 18 months, which is well below rent rises in other regional areas of Australia.

Real Estate analyst Propertyology has compared current advertised rents with January 2020 figures.

In Townsville and Byron Bay there’s been a 15% increase, Mount Isa and Port Hedland rents have gone up 18% and Hervey Bay prices are a whopping 39% higher.

The increases coincide with a shortage of rental properties.

According to the Real Estate Institute of Queensland, vacancy rates in more than 70% of the state’s rental markets are below 1%, which is classed as a tenancy crisis.

In Cairns, the rate sits at 0.8%, slightly tighter than Hervey Bay at 0.9%.

The median rent for a three bedroom house in Cairns is $420/week and for a two-bedroom unit the average weekly rent is $330.

##BA##

WHY THE RENTAL SQUEEZE?

According to Propertyology’s Simon Pressley, COVID-19 has only played a marginal role in the lack of properties available for rent.

He places the blame on the Australian Prudential Regulatory Authority's (APRA) credit squeeze in 2017, when the lending watchdog limited the amount of loans issued to investors as well as the amount of interest-only loans.

##PQ##

“It is not a COVID creation.

“It was APRA’s refusal to properly consider the full consequences of tightening credit policy that became the primary reason for Australian real estate today being locked up.”

APRA’s own figures show owner-occupied lending grew by over $10 billion in May but investor lending increased by only 0.1 per cent, or $900 million.

In recent weeks, it has actually foreshadowed another tightening of credit rules, warning there are signs of increased lending risk-taking as home buyers rush to secure loans while interest rates are at all-time lows and government stimulus packages are available.

The real estate market in Cairns is certainly experiencing the uptake, with house and land packages being quickly snapped up and building approvals increasing by more than than 150% year on year.

Once new homes are built, it will ease some of the pressure on the rental market, however experts believe more is needed to restore the balance.

WHAT’S THE SOLUTION?

According to Propertyology, removing lending barriers should be the first step.

“There is no quick fix but the only viable solution is to reduce barriers of entry for the everyday Aussie property investors who generate the rental supply,” Mr Pressley said.

“Immediately stop introducing policies that block the system, to restore stability and public confidence.

“Announce to the Australian people that they need not fear APRA again pulling the rug out from borrowers like they did a couple of years ago.”

The Real Estate Institute of Queensland (REIQ) has a different take.

It’s recommending the State Government amend its first home-owner grant to include the purchase of established properties.

“When it comes to new builds, it’s important to understand that the cost of new construction has increased by a staggering 220.3% between 1995 and 2018 while established housing has risen on average 113.95%,” said REIQ CEO Antonia Mercorella.

“So, by allowing first home buyers to access property beyond new construction and extend their support to purchase existing housing, it will expose them to more affordable price points.

“This in turn will help reduce pressure on the rental market while stimulating economic activity through the introduction of increased numbers to the broader property market.

“This will ultimately lead to increased real estate transactions which means increased taxation for the State.”

Main points

- The average Cairns rent has climbed 6% in 18 months

- A shortage of rental vacancies has pushed prices higher in most regional areas in Australia

- There are differing opinions on how to restore the balance