Would you pay $7 for your everyday latte?

Throw in some an alternative milk and an extra shot, and you could one day be forking out a tenner.

Oliver James of Tattooed Sailor and Guyala Café tells Tropic Now how your coffee is priced and why it’s probably going to go up.

##BA##

Words: Oliver James

Mark Dundon from Melbourne’s Seven Seeds, and father of third-wave specialty coffee in Australia, thinks the $7 flat white is coming.

Maybe not this year, or next, but here’s why.

##PQ##

In Brazil a few months ago, an unusual frost devastated about 10 per cent of Brazil’s coffee.

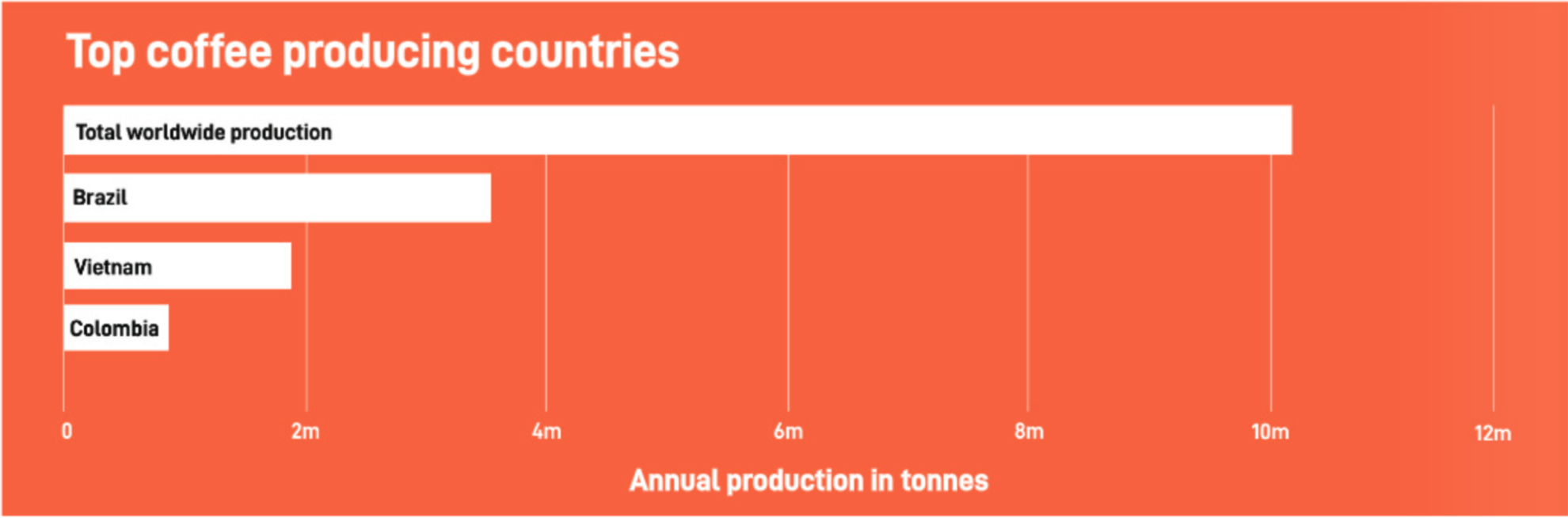

It pushed the coffee price conversation into the spotlight, and for good reason – Brazil grows over a third of the world's coffee, producing 3.48 million tonnes on average per year.

In comparison, Australia produces 600 tonnes per year. The recent loss is estimated at 348,000 tonnes, or 580 times what Australia grows.

With such a massive loss, green coffee from Brazil has nearly doubled in price and demand in other growing regions has skyrocketed.

This is on top of the tripling of container shipping costs since last year!

Higher temperatures are also an issue.

Mauricio Salaverria is a famous coffee producer I met in El Salvador, who’s been planting shade cover trees over his coffee for over 15 years to moderate temperatures, slow the ripening process and protect from ‘coffee sunburn’.

This practice has helped the MacLaughlin family at Skybury Coffee in Mareeba produce some of Australia's best cherries.

By co-planting with papaya, the coffee plants at Skybury thrive.

##PQ2##

Well, from 100 kilograms of freshly picked coffee fruit, the yield is about 18 kilograms of green coffee beans.

A producer in Ethiopia tells me growing fresh cherries costs the equivalent of AUD 78-90 cents per kilogram.

This puts the real cost of purchasing coffee beans at about AUD $5 per kilogram, before labour, water, transport, packaging and dry mill grading costs.

At Tattooed Sailor Coffee Roasters, we land Ethiopian coffee for around $12.50 per kilo.

A few months ago, we could land high-grade Brazilian beans for around $5 per kilo.

We can offset the cost of green cherries by blending different origins, through which we also achieve specific flavour profiles.

A markup of up to three-fold is required for a five per cent profit margin.

With rising green coffee costs, our two options are to source cheaper beans or raise prices.

I have always chosen the latter.

Sourcing quality ingredients is at the heart of my business model.

Cafes pay wholesale rates for freshly roasted beans of between $25 and $35 a kilo.

Add milks, sugar, takeaway cups, labour, and overheads and in my experience, any cafe selling less than 18 kilos per week will unlikely see profit.

So, is the $7 flat white coming? I think so.

I have curiously watched the retail price of a beer go up to $7, or even $12 and higher for crafted brews.

It is inevitable, and even necessary for specialty coffee prices to rise.

This story originally appeared in Tropic magazine Issue 32.