Ready, set, rise for Cairns real estate market

Leading economic forecasters predict Cairns property to be one of the nation's standout performers over the next three years.

House prices in Cairns are set to buck a nationwide real estate trend by rising at a higher rate than almost every capital city in Australia - including Sydney and Melbourne - over the next three years.

Cairns is predicted to be one of Australia’s stand-out real estate performers in contrast to over-heated capital city markets, the downturn in mining regions and generally weak employment conditions.

While those factors are combining to drag down median house prices in both Sydney and Melbourne by a cumulative one per cent each, the Cairns median house price is predicted to grow by a cumulative six per cent.

That’s the verdict of leading economic forecast firm BIS Shrapnel, which looked at trends and underlying market conditions across Australian capitals and regional centres for a three-year period to 2019.

A BIS Shrapnel spokesperson said house prices in Cairns would fare much better than our North Queensland cousins in Townsville.

“The Townsville market has steadily weakened as the impact of falling resource sector investment has impacted on housing demand, causing vacancy rates to rise and rents and prices to ease,” the spokesperson said.

“In contrast, the Cairns market did not experience the same benefit from the mining investment boom, with the post-Global Financial Crisis collapse in construction now resulting in a dwelling deficiency emerging.

“The Townsville market is forecast to continue to weaken, with investment in resource sector projects expected to progressively decline through to 2017/18.

“In Cairns a combination of low interest rates and tightening vacancy rates have contributed to a 19 per cent rise in the median house price in the four years to June 2016.

“Strengthening local economic conditions, with a lower Australian dollar contributing to strong growth in local and overseas tourism, are contributing to a more buoyant employment environment.

“Consequently, cumulative price growth over the three years to 2018 is expected to be six per cent in Cairns, while a four per cent decline is forecast in Townsville.”

Despite recent findings of slow-downs in property sales volumes and the median house price in Cairns, Rick Carr from Herron Todd White agrees that the longer-term fundamentals of the local property market “remain positive”.

In particular, Herron Todd White’s latest Cairns Watch report highlighted the increasingly tight rental vacancy rates for both houses and units, which stood at near stress levels of 1.7 per cent.

This extremely low rate combined with record low interest rates and strong tourism market will inevitably lead to increased investment and house price rises.

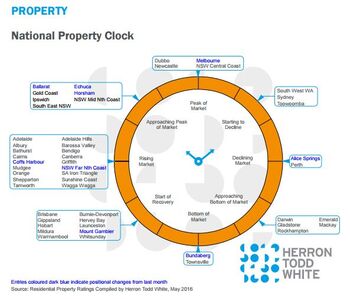

Herron Todd White is currently listing Cairns in the “rising market” phase of the firm’s national property clock, while Townsville languishes in the “bottom of market” phase.