Tropical North building approval trend shows a slowdown

New analysis by Conus economist Pete Faulkner shows vast differences in residential building approvals across Queensland.

The release of regional building approvals data for February has revealed disappointing data for the Cairns and Far Northern region on a trend basis.

As always, the unadjusted original data can be highly volatile so we should consider instead the Conus Trends.

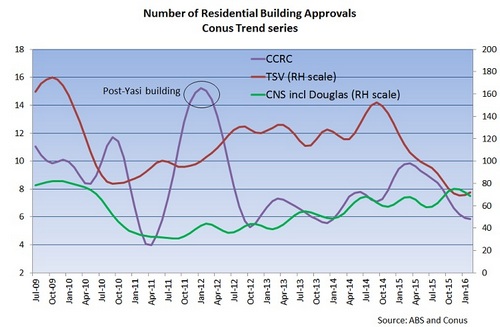

Here we see the Trend for residential approvals in the Cairns Regional Council (including Douglas Shire) fall to 69, after January was revised slightly higher to 72 from 71.

This equates to just a 2.3% increase from a year ago and a significant slowdown given that the annual increase has averaged almost 20% over the past 3 years.

The Cassowary Coast Regional Council area is static at 6 (after January was revised down from 7 to 6); this represents a 40% decline on the level a year ago.

As has been the case for some time, the bulk of the approvals in the CCRC area continue to come from the Tully SA2 area (which includes Tully, Mission Beach and Cardwell).

In Townsville the deterioration appears to have eased somewhat with the Trend rising to 72, with January revised up to 70 from 67. However this still means that the Trend is down 37.6% from a year ago and the annual change has been negative for the past 14 consecutive months.

CONUS LAUNCHES NEW TREND SERIES FOR ALL REGIONS

To improve the coverage of the regional Queensland economy we undertake at Conus Business Consultancy Services we have been working on the construction of the Conus Trend series for residential building approvals for all of the SA4 regions.

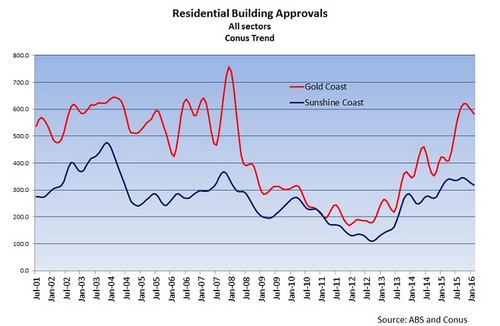

We are pleased to be able to now launch that data set. The graphs below give some idea of how this data could be used and highlights the variation across a selection of the regions.

In particular the graphs below show:

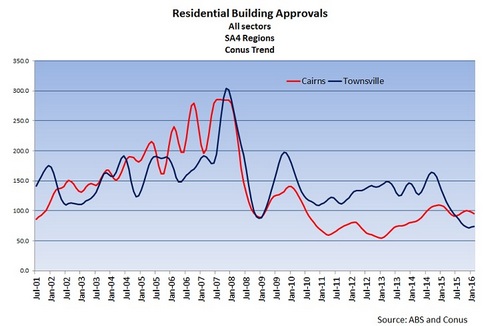

- the recent sharp decline in Townsville, and the very gradual recovery seen in Cairns which now looks to have run our of steam (note this data relates to SA4 regions and NOT the LGA data quoted above). Townsville has seen Trend approvals fall from 197 in November 2009 to just 74 now; the annual change (which has been negative for 14 consecutive months) is now at minus 68.5%

Other findings in the Conus Trend include:

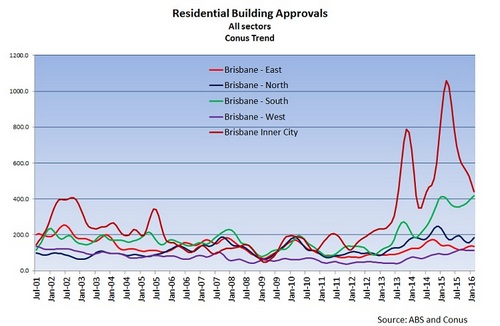

- the dramatic surge in approvals in both Brisbane – South and Inner City (even allowing for the wild swings caused by some big apartment approvals) while the rest of Greater Brisbane sees only modest improvements

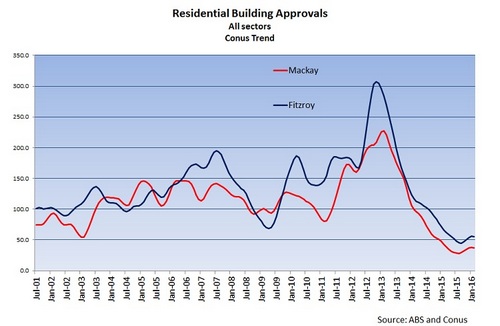

- the collapse in approvals caused by the unwinding of the mining investment boom in Rockhampton, Gladstone and Mackay regions

- the spectacular GFC-bust on the Gold Coast and the recovery on both the Gold and Sunshine Coasts