##MP##

Far North Queensland building approvals and new loan uptakes remain strong, despite soaring inflation and interest rate hikes.

324 houses and 64 units were approved in the region in the three months to July, with the total value of work increasing by 34 per cent.

That followed interest rate increases in May and June.

However, according to figures from the Australian Bureau of Statistics, the value of new home loans in June nationwide was 50.2 per cent higher than the pre-pandemic level seen in February 2020.

##BA##

Master Builders Queensland CEO Paul Bidwell said future demand for new home construction is still solid in most of the state's regions.

##PQ##

“Building approvals have also remained steady, which gives some important surety for an industry doing it tough,” he said.

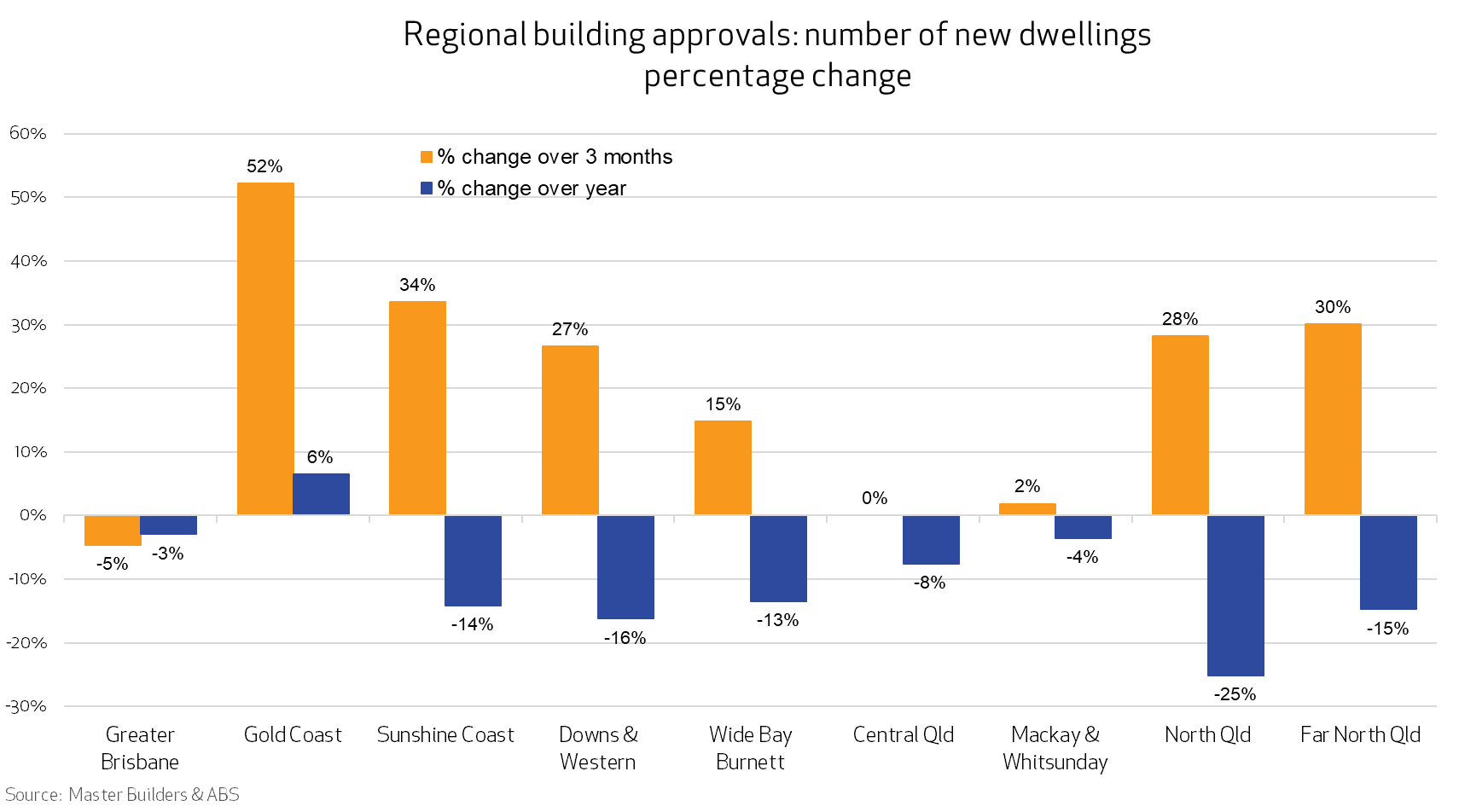

Statewide, building approvals for June saw an eight per cent increase for units, although houses dropped by the same amount.

Total dwelling approvals over the April, May and June period were up three per cent.

Greater Brisbane was alone in recording an overall fall, dropping five per cent over the same three months.

In contrast, Far North Queensland saw a 30 per cent increase.

The region’s Manager for Master Builders, Sharon Vella, said non-residential approvals are also steady and there remains a solid pipeline of work.

“Talking with industry stakeholders, we are wondering if the beautiful Far Northern region will buck the trend, with Brisbane on the decline on approvals and the regions in general still healthy,” she said.

##PQ2##

“Add in the units and other small commercial works and the current demand on all trades and materials is still strong.”

However, higher costs for materials and issues with supply chains coupled with continuing monthly interest rate rises has raised concerns the situation won’t last.

“With cost increases to the tune of around 30 per cent over the last 12 months and no end in sight to the rising costs and shortage of materials and labour, homeowners and banks are very wary of the potential for cost blowouts during the construction phase,” Mr Bidwell said.

“We know that some may shy away from building projects and for some, it may be a barrier altogether to affording the cost to build new or undertaking significant renovation work.

“We’re already seeing some developers put residential projects on hold and this trend does put something of a question mark over what the future holds.”

He said indications are that the situation won’t revert to more manageable levels until the back half of 2023.

Main points

- New dwelling approvals for Far North Queensland climbed 30% in the three months to July

- Loan approval figures for June show the value of new loans remains higher than pre-pandemic levels

- Rising interest rates and continuing materials and supply issues have some in the construction industry concerned