##MP##

The Reserve Bank of Australia has lifted interest rates by 0.5 per cent, bringing the official cash rate to 1.35 per cent.

Economists had predicted the move, as record low unemployment, global supply chain issues and record high fuel and energy prices continue to drive inflation.

It's the third rise in as many months, following a shock 50 basis points hike in June, which was the largest increase since February 2002.

In May, the rate climbed by 0.25 per cent.

##IAA1##

If passed on in full by the banks, mortgage holders with a $500,000 loan and 25 years remaining could cough up an extra $137 per month for repayments.*

Combined with rate hikes in May and June, it means borrowers will be paying an extra $333 per month, when compared to April's repayment.

Reserve Bank Governor Philip Lowe said one source of ongoing uncertainty about the economic outlook is household spending.

"The recent spending data have been positive, although household budgets are under pressure from higher prices and higher interest rates," he said.

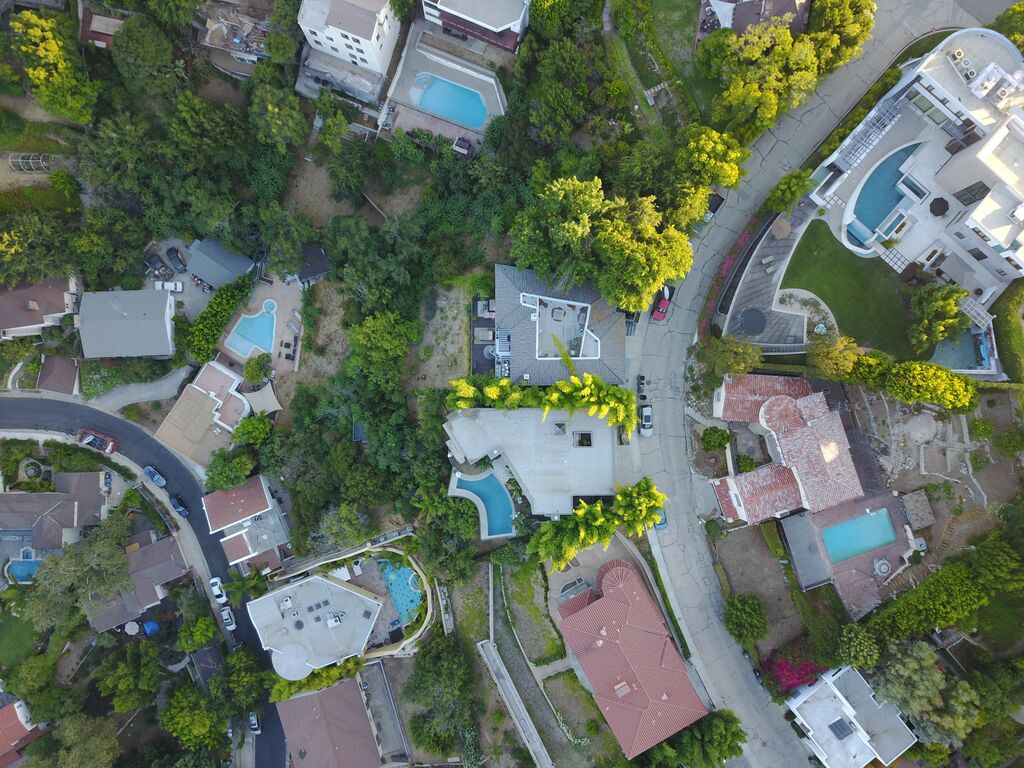

"Housing prices have also declined in some markets over recent months after the large increases of recent years.

"The household saving rate remains higher than it was before the pandemic and many households have built up large financial buffers and are benefiting from stronger income growth.

"The Board will be paying close attention to these various influences on household spending as it assesses the appropriate setting of monetary policy."

Further rate hikes are still expected alongside the rate of inflation, tipped to hit 7 per cent by year's end.

Many economists are speculating that the cash rate could increase to 2.35 per cent by the end of the year and peak at 2.85 per cent around mid 2023.

Rate City is predicting an increase to 2.60 per cent by February next year.

That would equate to an extra $685 in monthly repayments for a $500,000 loan, compared with the same period the previous year.

##PQ##

"As global supply-side problems continue to ease and commodity prices stabilise, even if at a high level, inflation is expected to moderate," Mr Lowe said.

"The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.

"The size and timing of future interest rate increases will be guided by the incoming data and the Board's assessment of the outlook for inflation and the labour market."

Main points

- The Reserve Bank has lifted interest rates today by another 0.5%

- The increase brings the official cash rate to 1.35%

- Those with a $500,000 loan can now expect to pay $333 extra on their monthly repayment, compared with what they paid in April