##MainPoints##

The founder of Joe Vella Insurance Brokers in Cairns has questioned the Federal Government’s plan to reduce insurance premiums in cyclone-prone North Queensland.

The coalition is designing a reinsurance pool for the region to underwrite cover for 500,000 residential, strata and small business policies.

The Federal Government says it would reduce premiums by $1.5-billion over 10 years.

However, Joe Vella, a 43-year veteran of the industry, thinks there’s a better option.

##ArticleBannerAd##

“I’m yet to be convinced,” Mr Vella said.

“My perspective has always been that both State and Federal should have offered the option of abolishing GST and stamp duty for postcodes that are heavily affected – effectively that’s 20% of the premium which could have been deducted.

##PQ##

“I don’t know the impact as to how it affects State and Federal purses … but putting a (reinsurance) pool together, that must come at a huge financial impost as well.”

Mr Vella told Tropic Now that natural disasters are not the only reason premiums have been rising, citing low interest rates impacting the investment returns of insurance companies as another major contributor.

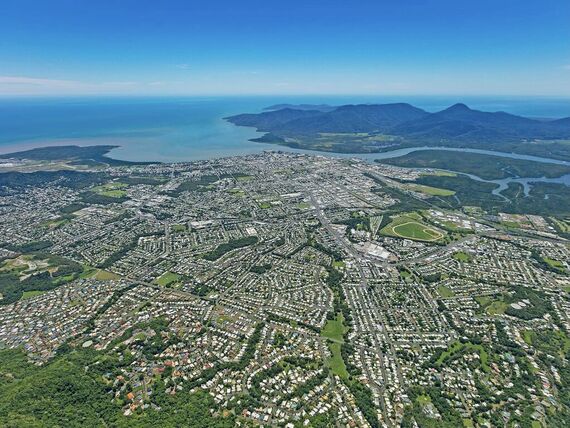

According to the broker, the city of Cairns is also ‘frustratingly tainted’ by what is perceived to be its storm risk, and he’s hoping his company’s merger with Queensland’s largest insurance broking house will give the region a greater voice.

The union, announced today, brings together Joe Vella Insurance Brokers (JVIB) with Regional Insurance Brokers, which has 13 offices including two others in North Queensland.

“Our buying power gives us an advantage and a hearing platform,” Mr Vella said.

“It gives us more scope for a closer ear to the higher echelons of the insurance industry.

“We can put up a stronger case for support.”

Regional Insurance Brokers handles $208-million in collective premiums among its 36,000 clients, which climbs to more than 40,000 clients through the JVIB merger.

Mr Vella will remain Managing Director of unchanged JVIB brand, emphasising he is not yet retiring even though he began thinking about succession planning when he faced a serious health battle five years ago.

“I had an illness which was a close call, so it was a case of listen to the dogs when they’re barking,” he said.

“I had an end date in mind and I had to establish how I was going to exit at some stage and a vehicle that would assist in that transition.

“I consider myself to be very privileged and I say that sincerely and I’m thankful for the staff and our clients to have this next transitional period.

“But I do need it emphasised that I’m not retired, I will be working three days a week.”

Main points

- Joe Vella favours insurance tax cuts over a reinsurance pool

- The Federal Government is designing a reinsurance pool which it says will reduce premiums by $1.5b over a decade

- Joe Vella Insurance Brokers has partnered with Queensland's largest insurance broking house